What in the Name of Macro Just Happened to Crypto

Billions liquidated. One insider made 192M. Here’s what really happened and what it means for traders like you

Hey! Kim here.

What a weekend.

Billions in crypto positions were wiped out.

Bitcoin fell $3,000 in minutes.

Many traders got caught on the wrong side of the move.

A few… made $192 million in half an hour.

So what really happened and what does it mean for you?

1️⃣ The Trigger: A Shock Tariff Announcement

Late Friday afternoon, after traditional markets had already closed, U.S. President Donald Trump announced on Truth Social that he would impose a 100% tariff on all Chinese imports starting November 1.

It was an escalation in the ongoing trade tension between the two biggest economies in the world.

China had recently imposed export controls on rare metals critical for manufacturing particularly semiconductors, EVs, and defense technology.

The U.S. responded with tariffs.

And when the stock market was closed… crypto became the pressure valve.

2️⃣ The Flash Crash

Liquidity was thin.

Leverage was high.

Algorithms reacted faster than humans could.

Bitcoin dropped by $3,000 almost instantly.

Billions were liquidated across exchanges.

Meanwhile, one insider wallet reportedly made $192 million in just 30 minutes.

Binance lagged, Hyperliquid profited, and Coinglass was attacked.

Analysts compared the speed of the move to the COVID-19 crash.

3️⃣ The Manipulation Question

Was this manipulation? Maybe.

But here’s the uncomfortable truth, every market is manipulated to some degree.

The stock market.

The bond market.

The currency market.

The game is what the game is.

Our job is to learn the rules and play them better than the rest.

4️⃣ The Lesson for Traders

If your psychology is strong, moments like this don’t destroy you.

If it isn’t, they reveal where your risk management is weakest.

Events like these aren’t just financial test, they’re emotional audits.

They show:

How well you handle volatility.

Whether you respect your stop-losses.

Whether you panic when others do.

If you lost money this weekend, don’t spiral. You’re either:

1️⃣ A consistently profitable trader (you survived), or

2️⃣ Not yet consistent (you just got feedback).

Both are fine.

Just don’t stay in between.

5️⃣ The Macro Outlook

In the short term, expect volatility as traditional markets open and digest the news.

In the medium term, much depends on how politics plays out.

If the U.S. and China walk this back, risk assets could recover.

If not, brace for more turbulence across equities, crypto, and commodities alike.

The reality is that these two economies need each other.

Trade wars sound tough, until the domestic pain kicks in.

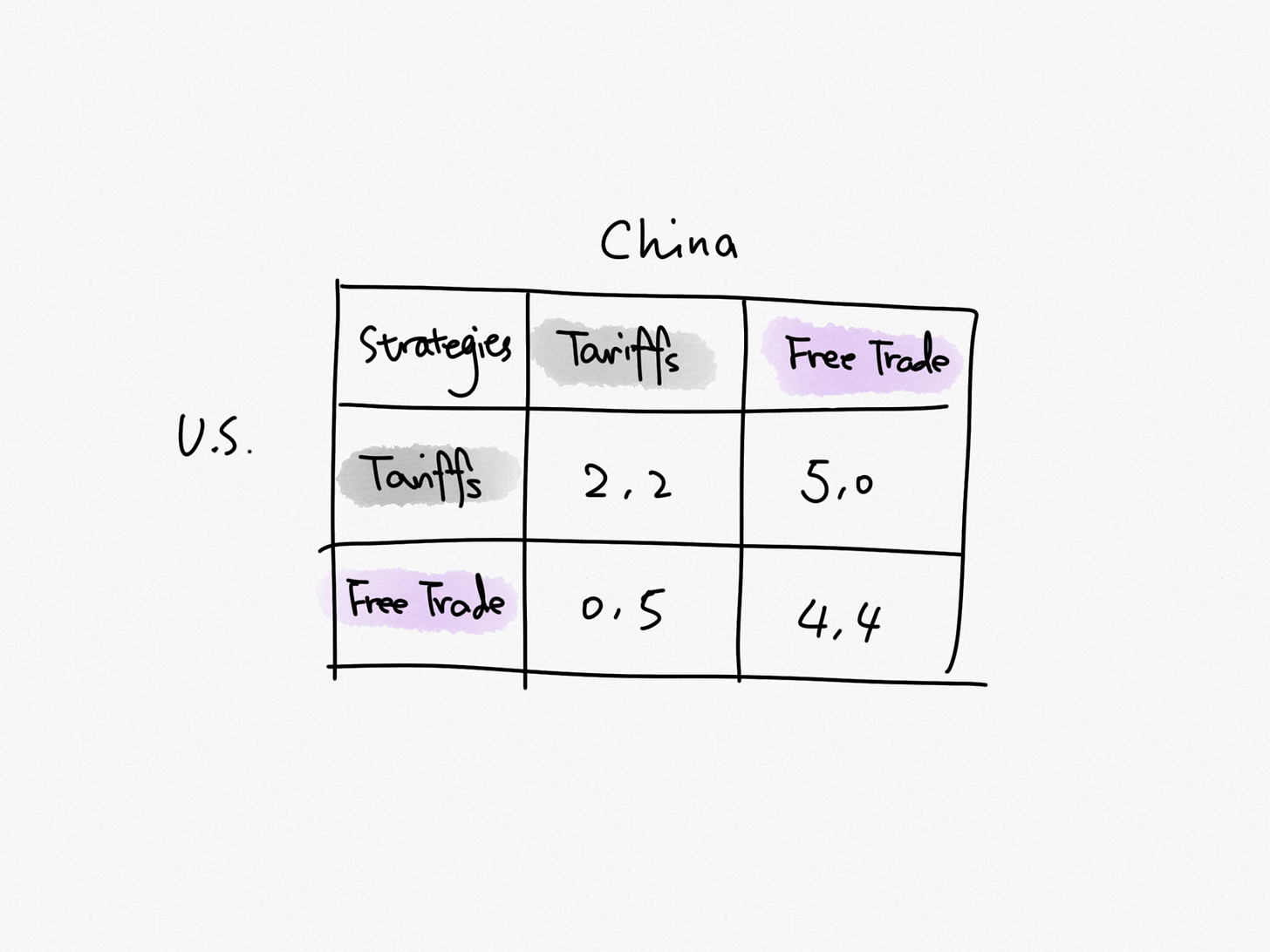

Economic theory is clear: free trade creates the highest total welfare.

Tariffs create winners and losers… and volatility.

6️⃣ The Human Side

If you’re feeling shaken by this move, you’re not alone.

Check in on your trading friends.

Events like this can be emotionally draining.

Sometimes, the best trade is a day off.

7️⃣ Final Thoughts

Keep learning macro.

Keep mastering risk management and trading psychology.

That’s how you thrive, even in a rigged game.

Until next time,

KimTalksCrypto

Disclaimer: This newsletter is written and distributed for educational purposes only. All views expressed are my own. Nothing in this newsletter is to be taken as financial advice or recommendation for any investment.