What to Watch at the Sept 17th FOMC (and Why It Matters for Crypto)

Everything you need to know explained in 5 minutes.

Hey! Kim here.

The next big macro event for crypto traders is just around the corner: the FOMC on Sept 17th, 2025.

A few years ago you might’ve been able to ignore this stuff. Not anymore. Trading blind to what the Fed is doing means you’re missing one of the strongest drivers of liquidity, and liquidity is what fuels crypto.

Here’s what’s going on 👇

🔹 What the Market Expects

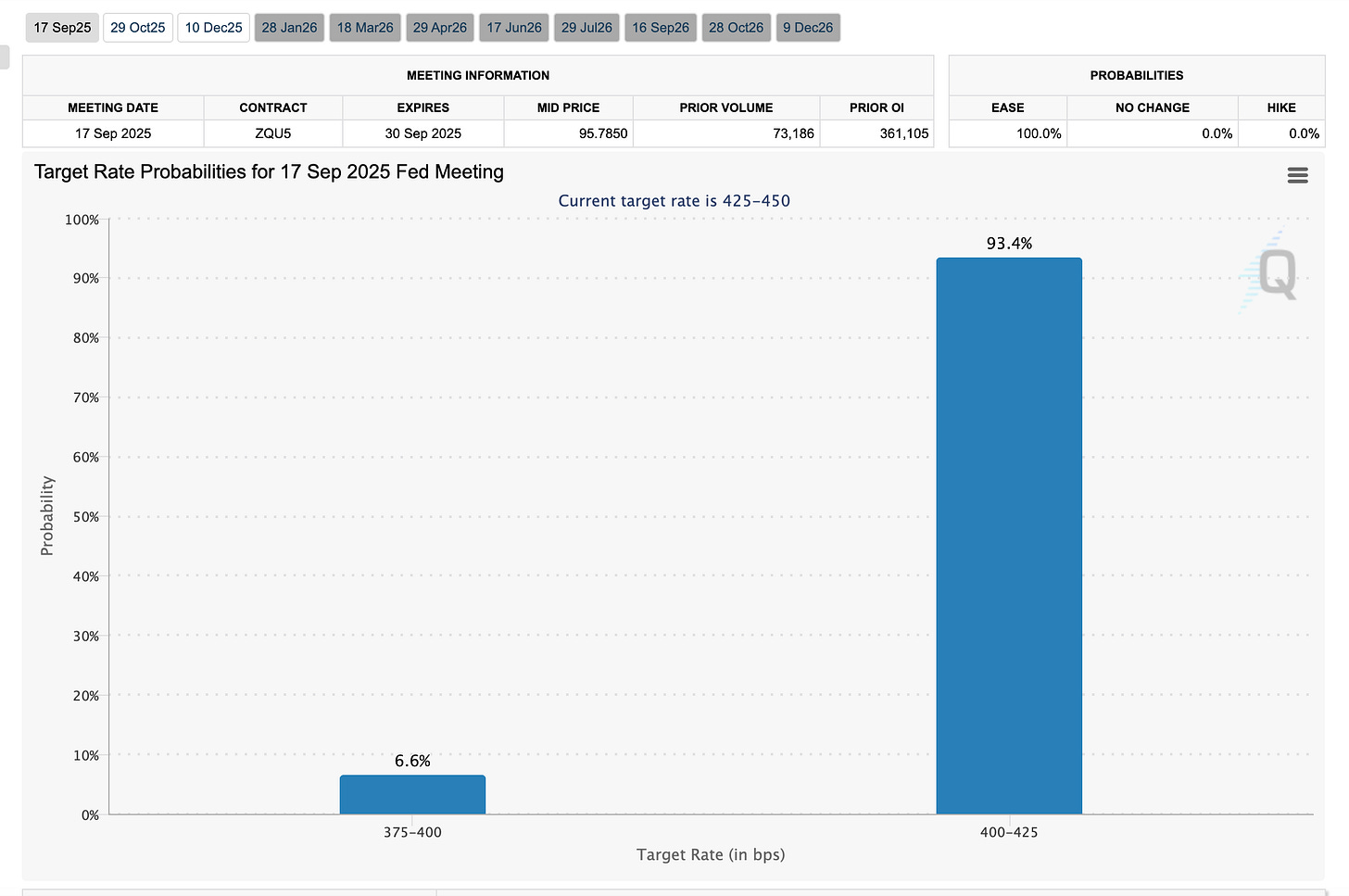

Current Fed Funds Rate: 4.25–4.50%

93% chance of landing at 4.00–4.25% (25 bps cut)

7% chance of landing at 3.75–4.00% (50 bps cut)

Source: CME FedWatch Tool

Translation: A rate cut is fully priced in. The real question is the size.

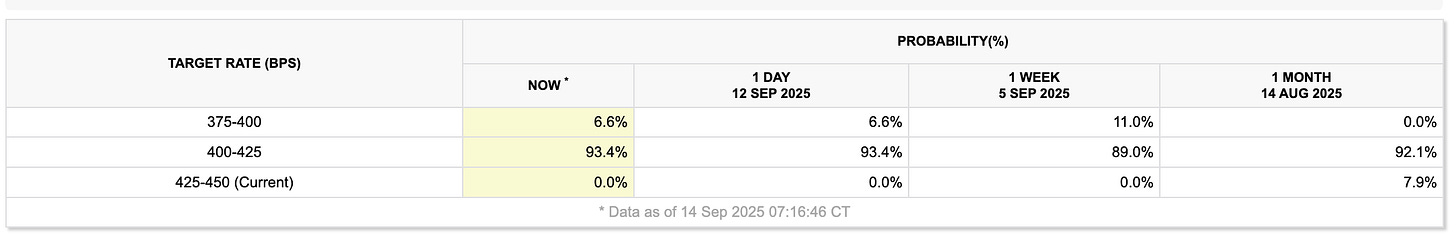

🔹 How Expectations Have Shifted

Source: CME FedWatch Tool

One month ago:

92% odds of a 25 bps cut

8% odds of no change

Today:

93% odds of a 25 bps cut

7% odds of a 50 bps cut

In short: the “no cut” camp has disappeared. Better inflation data + a stabilizing macro backdrop have investors more confident that the Fed can ease without losing control.

And easing = more liquidity = historically bullish for crypto.

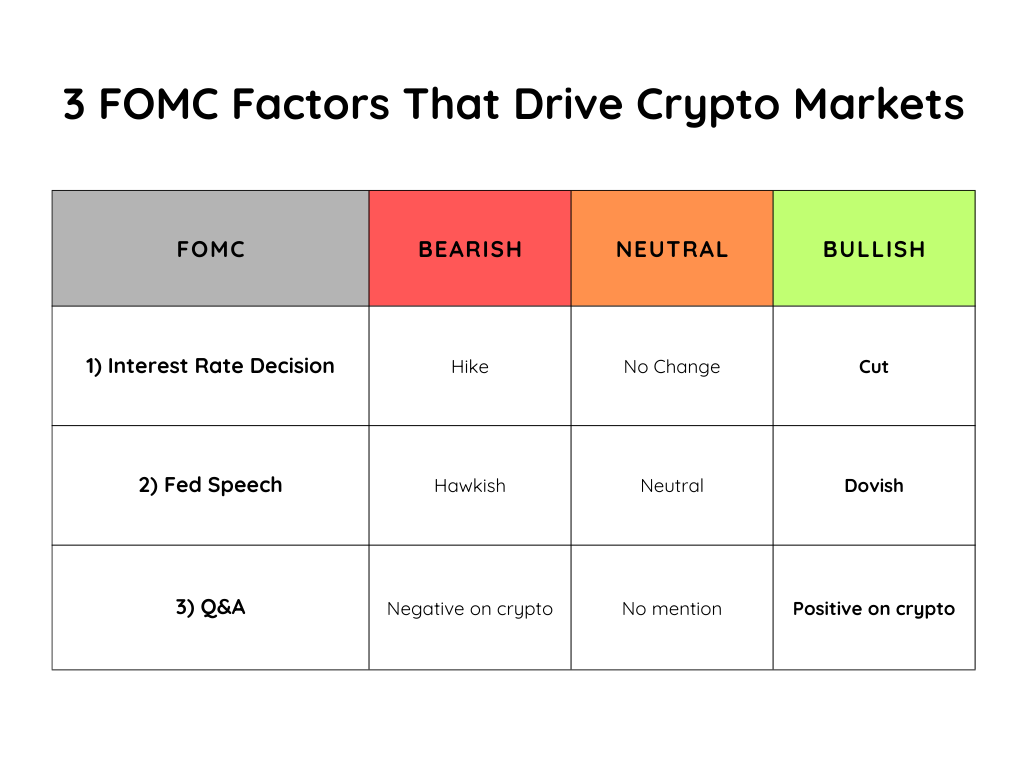

🔹 Why the Decision Alone Isn’t Enough

Even if the Fed cuts rates, that’s just Step 1.

Two other pieces matter just as much:

The Chair’s Speech

Dovish language (“we can keep cutting, liquidity is coming”) → bullish

Hawkish language (“inflation risk remains, this cut is one-off”) → bearish

The Q&A

Live questions can swing markets in minutes.

Example: If Powell hints at stricter crypto regulation, it could erase bullish sentiment instantly, even after a rate cut.

🔹 The 3 Things You Need to Watch

Rate decision → a cut is bullish

Chair’s speech → dovish = bullish

Q&A session → neutral or positive on crypto is best

For a clear positive market reaction, all three need to align. If even one is hawkish, the upside can vanish. That’s why traders sometimes complain: “Why didn’t BTC pump after the cut?” → this is often the reason.

🔹 How to Approach It as a Trader

Watch live (usually 2pm ET on YouTube)

Decide in advance: trade the event, or stay flat for that volatile hour

Either way, treat it as a learning opportunity. Track how each element (cut, speech, Q&A) affects BTC and ETH. That playbook will be gold for the next Fed meeting.

Bottom line: The Sept 17th FOMC isn’t just about the rate cut. It’s about the full picture: the decision, the tone, and the Q&A. Get all three right, and you’ll understand the flows driving crypto in real time.

Until next time,

KimTalksCrypto

Disclaimer: This newsletter is written and distributed for educational purposes only. All views expressed are my own. Nothing in this newsletter is to be taken as financial advice or recommendation for any investment.

I vote bullish. Hope I’m right 🤝