Hello everyone

Monday was weird… Bitcoin pumped to $30k. Then dumped back down again.

What lessons can we draw from the price action and what does it mean for the future of the crypto markets?

Monday Mania

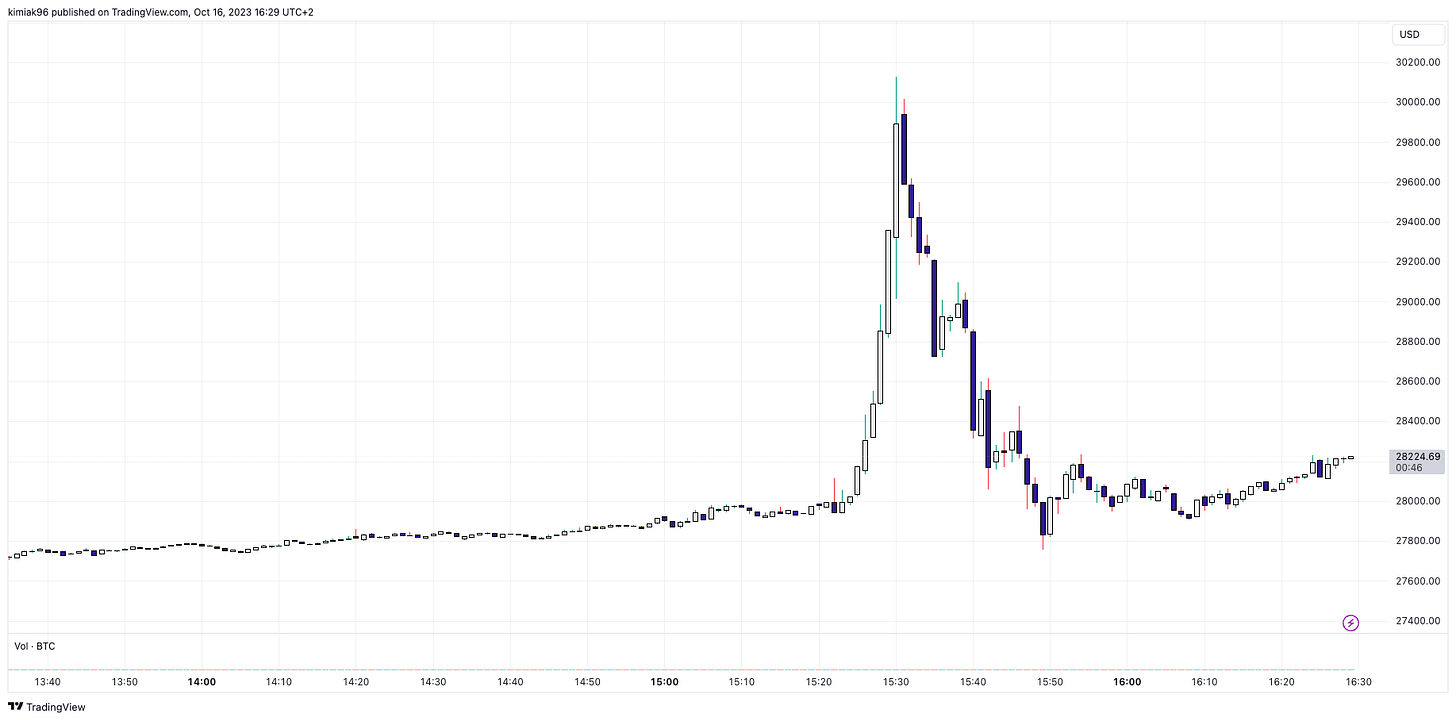

On Monday, the market got excited by fake reports that BlackRock’s spot Bitcoin ETF had been approved. Notice the giant green candles that were printed on the $BTC chart.

This news turned out to be fake. Hence the giant red candles that came immediately after. What you can’t see on my chart is the $100 million of liquidations.

An absolute rollercoaster moment. Arguably, some of the most interesting price action we’ve had all year!

NOTE: it can be tempting to feel FOMO missing big volatility like this. Remember it’s brutal to trade these kinds of market conditions, if you don’t have a strategy for it, it's better to stay out.

What Does It Mean?

Before Monday, many investors and traders were curious what spot Bitcoin ETF approval would mean for the markets

Some people think spot Bitcoin ETF approval will catapult us into the next bull market

Others believe it is a non-event. That any impact on $BTC price has already been ‘priced in’

So, there is this narrative going around that the fake ETF approval pump is foreshadowing the reaction to the real event. Mile Deutscher shared 2 main reasons why this is a flawed argument:

Timeframe. The fake pump occurred over the span of about 10 minutes. To really head toward bull market territory, we would need to see buy pressure sustained over a much longer timeframe.

Current market conditions. In these low-volume conditions, it’s easier to see a sudden green candle.

Whilst it was positive to see the markets react to good news, it’s difficult to say that based on this fake pump, there will certainly be a new bull market if we get real spot ETF approval.

Wen Spot ETF Approval?

Source: James Seyffart

See above the dates for the spot Bitcoin ETF race.

The next deadline that is coming up is 17th November 2023 for the Hashdex and Franklin applications

That being said, most people are optimistic about BlackRock’s application and the next deadline for BlackRock is 15th January 2024

Will the SEC approve?

The SEC recently lost in court to Grayscale, with the court saying it made no sense to have a futures Bitcoin ETF and not a spot ETF. So, there’s a lot of pressure on the SEC here…

They also confirmed that they will not be appealing the court’s decision

ARK CEO Cathie Wood confirmed that the SEC asked questions regarding the spot Bitcoin ETF (suggesting they are entertaining the idea).

The key is just getting one approval. If one is approved, they will likely all be approved.

In 2024, market conditions are expected to be higher liquidity, combine that with a potential spot Bitcoin ETF approval and things are looking pretty good…

All the best,

KimTalksCrypto

Disclaimer: This newsletter is written and distributed for educational purposes only. All views expressed are my own. Nothing in this newsletter is to be taken as financial advice or recommendation for any investment.

Clear and concise. Enjoyed this article. Thanks Kim. Personally I still think jumping on the computer on 1-5 minute timeframes with higher leverage and good risk management is somewhat illogically the safest way to trade atm. Do this for an hour and enjoy the rest of the day. This only applies to trading bag not investment bags obviously.